The Resurgence of Domestic Infant Formula Brands

The melamine scandal was a black swan event that reshaped the Chinese infant formula sector. Despite occurring over ten years ago, the sequelae of the disaster are still impacting the domestic industry. The market share of domestic players was 70% in 2008 and had dropped to 30% by 2015 [1]. However, in recent years, the market proportion of Chinese domestic milk powder brands has been rising, and by 2019, domestic stakeholders control more than 60% of the market [2].

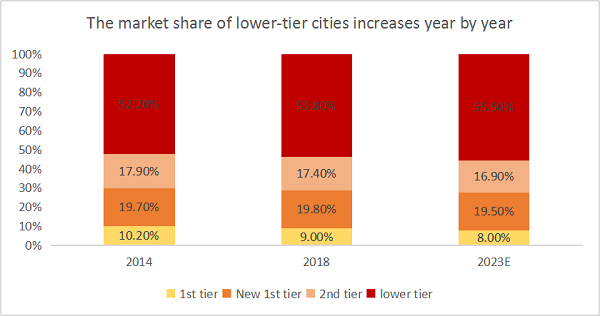

The biggest advantage of most domestic brands is their ability to organize channel services in lower-tier cities. An important fact is that in the past two years, the birth rate in China has been declining, and the number of newborns in third to sixth tier cities accounts for 80% of all births. The market of lower-tier cities accounts for nearly 60% of China’s infant formula market [3]. At a macro level, growth in China's infant milk powder market is currently stagnant. However, third and lower-tier cities, have faster population growth and greater demand for infant formula consumption. In these cities, domestic stakeholders are dominating.

Data source: China Feihe prospectus, Frost & Sullivan, China Merchants Securities

Domestic brands perform better in the lower-tier market

According to the 2018 China Shopper Report released by Kantar Consumer Index, in the first and second-tier markets, the market share occupied by imported milk powder brands (mainly high-end) has reached 80%. But in third and lower-tier cities, where there is a higher birth rate, the market share of domestic brands is more than 60%. Domestic brands are establishing a stranglehold on China’s key growth market. Consumers in first and second-tier cities are used to buying milk powder online, but for consumers in lower-tier cities, they still largely rely on offline channels to purchase milk powder. The 2018 China Shopper Report pointed out that bricks-and-mortar maternal and child stores account for about 75% of sales in lower-tier cities and towns.

Major imported infant formula brands have bigger market shares in China’s 1st and 2nd tier cities.

| Brands | Danone | Abbott | Wyeth | a2 |

| Channel structure | 1st and 2nd tier: over 50% | 1st and 2nd tier: 80% 3rd-5th tier: 20% | 1st tier: 40%-50% 2nd-3rd tier: 40% Others: 10% | Mainly in the 1st and 2nd tier cities |

Source: In-Depth Report on Infant Formula Industry, China Merchants Securities Research Institute

Major domestic infant formula brands have pooled resources in China’s lower-tier markets.

| Brands | Feihe | Yili | Beingmate | Junlebao |

| Channel structure | Starting from 3rd and 4th tier cities | Mainly focusing on the lower-tier cities, and the 2nd and 3rd tier cities are the current priority | 3rd and 4th tier cities account for a higher proportion, with market share rising from 7.2% to 8.4% | Starting from lower-tier cities |

Source: In-Depth Report on Infant Formula Industry, China Merchants Securities Research Institute

Domestic brands have established their dominance in lower-tier city offline channels using two key strategies 1) a dealer management mode and 2) local promotion. Take Feihe as an example. In Henan province alone, the number of dealers and promoters is more than 100 and 1500, respectively, whereas Mead Johnson has only 200 promoters [4]. According to Feihe's financial results, as of June 30, 2019, the company’s dealers and retailers have a presence in more than 109,000 retail outlets. In addition, Feihe has thousands of consumer education teams as well as shopping guides in various maternal and infant stores to help sell products. It has also built up a large rural sales network in China’s populous provinces, where users have limited access to foreign brands [5]. This strategy has led to rapid market penetration and is helping Feihe get closer to consumers and helping it to establish trust and brand loyalty. Nielsen data shows that as of September 30, 2019, Feihe’s milk powder sales ranked No.1 in the industry, with a market share of nearly 12%.

Tips for overseas brands expanding to lower-tier markets

Although foreign brands such as Danone, FrieslandCampina, and Wyeth are also accelerating the pace of their expansion into China’s lower-tier cities, it is comparatively slow compared to their domestic rivals. According to the In-Depth Report on Infant Formula Industry, there are three major barriers for foreign companies in lower-tier markets:

Staff retention is a major issue. The frequent rotation of management level staff and short tenure of key decision-makers in foreign-invested enterprises leads to a lack of policy continuity and a corresponding lack of stability in the sales and marketing teams. This hinders the in-depth and continuous exploration of market expansion into lower-tier markets.

Securing and retaining support from distributors and promoters is also a problem. The talent management methods and the unified compensation system adopted by foreign-invested companies makes it difficult for them to support large-scale terminal services and to retain the promotional personnel necessary to forge close relationships with local retailers and to influence the purchasing decisions of consumers in these markets.

Imported brands mainly rely on branding to tap into the lower-tier market with the help of large maternal and infant chain stores (numbers in lower-tier cities are limited), or multi-level wholesalers. These approaches are slower to yield results and do not align with optimal strategies needed to succeed in lower-tier cities.

For overseas brands, looking to gain ground in the lower-tier market, they must give top priority to the small and medium-sized maternal and infant stores. Because in small cities and towns, relationships matter. The storekeepers of maternal and infant stores shape consumers’ purchasing decisions, in a similar way that China's internet KOLs and celebrity brand ambassadors can. Usually, a storekeeper can help form buying groups aggregated from 1,000-2,000 mothers, who spend a lot of time shopping and spending [6]. The storekeeper’s recommendations are more important in guiding purchasing decisions than the branding of imported products.

Consumers in lower-tier cities have less awareness of imported brands. Foreign brands need to increase brand exposure and visibility in the lower-tier market because consumers there need to be educated on any alleged advantages offered by imported brands. In a survey conducted by All-Weather TMT, more than half of the consumers who chose domestic milk powder said they would put more trust in brands endorsed by celebrities. By increasing branding and marketing through channels like elevator advertisement, TV drama product placement, or short video promotion, overseas brands will be able to form a lasting impression and win the hearts and minds of consumers in lower-tier markets.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by