On April 15, 2021, invited by FI Global, ChemLinked regulatory analyst Lorraine Li shared her opinions about the Korean food market in Fi Global CONNECT - Regions in the Spotlight1. She talked about the opportunities and challenges in the Korean food market and also gave her suggestions to overcome the barriers. ChemLinked presents the key points of the webinar in this article.

1. Overview

South Korea is a great place to expand food business in Asia. It has the 12th largest economy in the world, representing 1.6 trillion USD. The trade volume in 2019 remained the 8th across the globe. As South Korea has signed free trade agreements with many countries2, such as China, USA, European Union, ASEAN, Japan, Australia, etc., enterprises from these areas can enjoy preferential tariff rates.

The food market in South Korea also shows a steady upward trajectory in the last decades. The food market volume amounted to over 145.3 billion dollars in 2019. Despite the corona impact, the import value of many food categories, such as processed agriculture products, beer, and Kimchi, have seen increases last year.

2. Opportunities

2.1 Hot Imported Products in Great Need

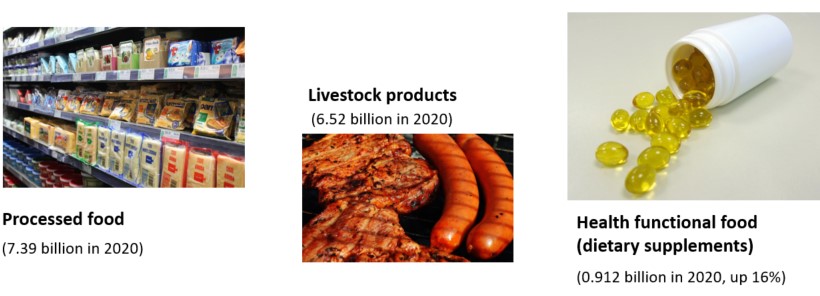

With limited agricultural production capacity, South Korea relies heavily on imported processed food and livestock products. In 2020, South Korea imported over 7 billion USD processed food and 6 billion USD livestock products. Besides, health functional food is also in great demand amid the COVID-19. For enterprises intending to trade with S. Korea, the processed food, livestock products, and dietary product are great choices.

With limited agricultural production capacity, South Korea relies heavily on imported processed food and livestock products. In 2020, South Korea imported over 7 billion USD processed food and 6 billion USD livestock products. Besides, health functional food is also in great demand amid the COVID-19. For enterprises intending to trade with S. Korea, the processed food, livestock products, and dietary product are great choices.

2.2 Promising Products

(A) General Food with Function Claims

With an increasing awareness of the importance of health, dietary supplement is in great demand. However, dietary supplement application is difficult and costly in South Korea. To ease company’s burden, the Korean authority issued a new law to introduce the "general food with function claims"3 last year. This regulation permits general food to label “function claims” if it contains specific functional ingredients.

The import process of "general food with function claim" is much easier than dietary supplements. The enterprises only need to submit two additional documents to get approval. Other requirements are the same as those of the general food. Many experts think it is good timing for this new food category entering Korean market.

(B) HMR Food

HMR is short for Home Meal Replacement. It is instant food with semi-prepared food materials and seasoning, which helps people cook indoors easily and quickly.

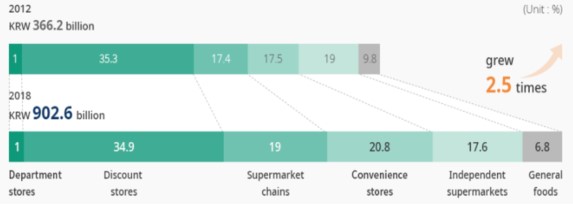

Figure 1: HMR Food Sales in Different Distribution Channel in 2012 and 2018 (Source: Invest Korea)

The sales of HMR food boosted up 2.5 times within just six years. The pandemic has also accelerated HMR food sales. According to CJ online shopping mall4, the sales of HMR food skyrocketed 84% in just one week after the outbreak of COVID-19 in South Korea.

The increasing one-person household is the main consumer group. As this group is expected to be over 30.9% of the population by 2022, the HMR food would be in greater demand.

Image 1: Example of HMR products (Source: johncookmarket.com)

(C) Food for the Elderly

Food for the Elderly refers to easy-to-digest food with nutrients. Korea has one of the largest elderly populations in the world. Till 2030, Korean people over 65 years old are estimated at more than 24% of the whole population.

The silver food market value is expected to hit 133.5 million dollars in 2021, which is twice that in 2015. The food for the elderly is deemed as a promising category in the following years.

Figure 2: Market Value of Food for the Elderly (Source: mafra.go.kr)

2.3 E-Commerce: A Surge in Online Purchasing

South Korea has the 5th largest e-commerce market in the world, and food is one of the categories most frequently traded online. South Korea’s online food market increased rapidly in early 2020 as people were required to keep social distance. The value of the online food market hit 39.2 billion dollars last year, representing the YOY growth of 62%.

Figure 3: Online Food Market Value (Source: Invest Korea)

The South Korean e-commerce trade channel can be sorted as local e-commerce platform and cross-border e-commerce platform. It's more convenient for enterprises to conduct imported food business via cross-border e-commerce platforms. There are no mandatory requirements on food selling on cross-border e-commerce platforms so long as the distributor is officially registered with the Ministry of Food and Drug Safety (hereafter referred to as MFDS).

3. Challenges and Suggestions

After reviewing all the opportunities, enterprises need to face and overcome several challenges to access Korea's food market smoothly.

3.1 Challenges

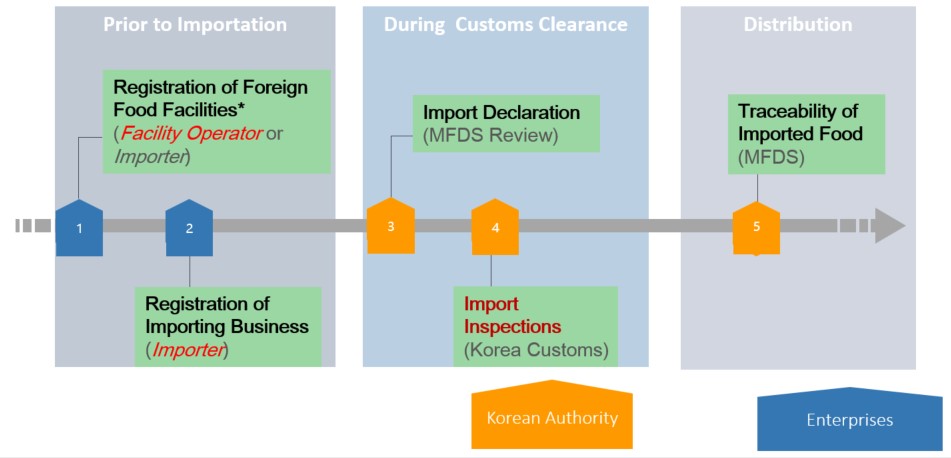

South Korea has rigorous controls on food safety. Fully understanding the country's regulatory environment is the first and foremost step to enter the market. The food import procedure can be divided into three parts: before the importation, during the customs clearance, and the distribution. Each step requires compliance.

Before selling food to South Korea, the overseas enterprise first needs to establish a responsible distributor as its importer in South Korea and then help the distributor complete two registrations: foreign food facility registration and business registration. These two registrations are crucial and indispensable for passing MFDS' review in the customs clearance.

During the customs clearance, the Korean Customs will inspect the applications and products. If a product fails in complying with the Korean food standards5, the customs will regard it as a hazardous product and bans the importation.

Furthermore, the distributor should provide the traceability information of livestock products, infant food, and other foods for special consumer groups to MFDS during the distribution.

Figure 4: South Korea Food Import Procedure (Source: ChemLinked)

3.2 Suggestions

Distributor plays an important role in the food trade as can be seen from the above information. Therefore, finding a reliable distributor is significant. The distributor not only helps the company sell food products in South Korea, but also acts as a responsible entity for the food safety. Enterprises can establish a branch office in South Korea. However, ChemLinked suggests that cooperating with an experienced local company is more economical and helpful, especially for enterprises having no experience doing business in S. Korea. The local company knows the local market and could react quickly to the regulation changes and product trends.

Product compliance is another essential issue. To pass the import inspections and ensure the food safety, the imported food shall comply with Korean food standards5. South Korea has some overarching laws, such as Food Sanitation Act6, and Imported Food Act7, to regulate the general requirements. There are also some supporting standards to detail the standard for each category, such as Food Code8, Food Additive Code9, etc. South Korea also modifies the food standards frequently. Enterprises can refer to regulation information platforms, such as ChemLinked, to keep informed of the regulation updates.

Besides, understanding Korean consumer habits is essential to promote overseas products in South Korea. Korean people are very connected. They enjoy using social networks to explore and review products before purchasing. Product reviews can influence the consumers' purchase intention. Thus, cooperating with internet influencers is a popular way of market promotion. Also, Korean people like free samples and discounts. When you walk around in Seoul, you'll see advertisements like "1+1", "2+1" all around. Overseas companies can support the retailers in such promoting.

Read More

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by