According to data issued by Research and Markets, "A Study of China's Beer Market 2017" [1], China's beer market is projected to reach RMB 683 billion yuan by 2019, making China the largest beer producer in the world followed by the United States. In addition, China is also the largest consumer of beer in the world. In 2015, Chinese consumers imbibed double the volume of beer compared to their American counterparts (18 billion liters).

According to data issued by Research and Markets, "A Study of China's Beer Market 2017" [1], China's beer market is projected to reach RMB 683 billion yuan by 2019, making China the largest beer producer in the world followed by the United States. In addition, China is also the largest consumer of beer in the world. In 2015, Chinese consumers imbibed double the volume of beer compared to their American counterparts (18 billion liters).

Despite the alluring investment prospect offered by these eye-catching top trump statistics, investment in China's beer sector actually requires careful consideration. The beer market has already shown signs of saturation. Although the overall sales value continues to grow, the domestic output and sales volume in China has been trending downwards in recent years. Does this reduction in volume and the concomitant increase in value point to a trend towards premiumization and fit with the narrative of the refining palates, deeper pockets, demand for higher quality and heightened demands for new experiences amongst Chinese middle class or is there more at play?

Saturated Market in China

|

According to the National Bureau of Statistics of China [2], the domestic industry output of beer in China has been shrinking since 2013. Although the import volume keeps rising stably (source: GAC [3]), it only accounts for a small part of the total volume. As for the market performance, the sales volume of beer showed a downward tendency from 2013-2017 (source: Alcoholic Drinks in China [4], Euromonitor International). However, the sales value has risen steadily in China despite the decline in sales volume. What happened? Price rise and the upgrade of the industrial structure seem to be the main causes.

However, the sales value has risen steadily in China despite the decline in sales volume. What happened? Price rise and the upgrade of the industrial structure seem to be the main causes. 2018 marked the first time in over 1 decade that China's beer industry as a collective raised the price of beer products. The move is seen as a response to curb flagging bottom lines, offset the negative influence of increased production costs and competition from other sectors of the alcoholic beverage sector and to realign strategies towards a change in consumer demand. At the beginning of 2018, industry leaders increased the price of products across the board. Notable examples include Yanjing, China Resources, Tsingtao who all increased prices from between 5%-15%, while the price of Carlsberg rose by 50%. (HKEX Announcement [5], China Resources)

2018 marked the first time in over 1 decade that China's beer industry as a collective raised the price of beer products. The move is seen as a response to curb flagging bottom lines, offset the negative influence of increased production costs and competition from other sectors of the alcoholic beverage sector and to realign strategies towards a change in consumer demand. At the beginning of 2018, industry leaders increased the price of products across the board. Notable examples include Yanjing, China Resources, Tsingtao who all increased prices from between 5%-15%, while the price of Carlsberg rose by 50%. (HKEX Announcement [5], China Resources)

At the same time, the sales volume of middle and high-end beer products are increasing as follows. (Source: China Merchants Securities, Euromonitor [6]) (Note: low-end beer: under 7 yuan/liter; middle end: 7-14 yuan/liter; high-end: above 14 yuan/yuan) Besides raising the price, what did industry leaders do to cope?

Besides raising the price, what did industry leaders do to cope?

China's Big 5

|

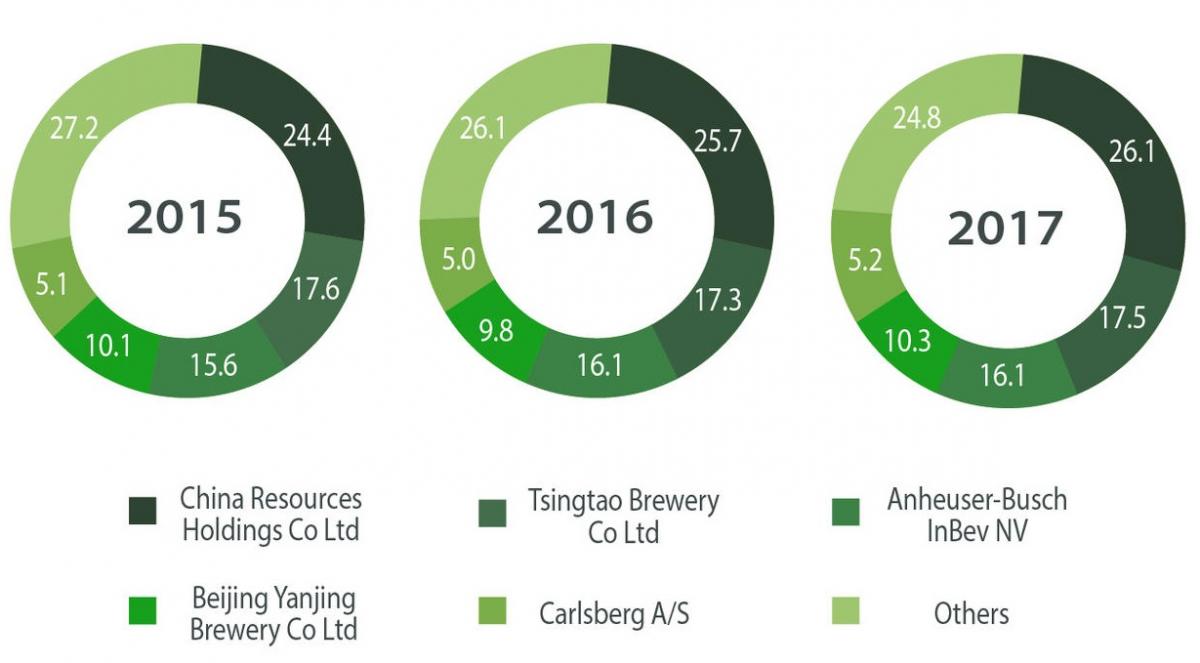

GBO Company Shares of Beer in China: % total volume, 2015-2017 (Source: Euromonitor International) Constant negative growth has forced these giants to explore the high-end beer market.

Constant negative growth has forced these giants to explore the high-end beer market. According to interim reports published by Tsingtao [7] and China Resources [8], both of them are going to emphasize the production of high-end beer products. Carlsberg is also using this strategy as shown on its official website [9].

According to interim reports published by Tsingtao [7] and China Resources [8], both of them are going to emphasize the production of high-end beer products. Carlsberg is also using this strategy as shown on its official website [9].

Annual report of China Resources, 2018: Following the 2018 launch of "Concept Series" designed to target the premium segment, China Resources launched "Brave the World superX". This new product will launch nationwide and is a mid to high end product designed to meet the evolving demands of the younger generation. |

High-end brands of five giants

| Company | High-end Brands |

| China Resources | Opera Mask, Snow Pure Draft, etc. |

| Tsingtao | Artistic (奥古特), Good Luck (鸿运当头), Classic 1903, Tsingtao Pure Draft, etc. |

| AB InBev | Corona, Hoegaarden, etc. |

| Yanjing | Yanjing Original Weissbier, Yanjing Pure Draft, etc. |

| Carlsberg | Tuborg, Carlsberg, 1664 Blanc, etc. |

In terms of product stratification, China Resources and Tsingtao are still dominated by low to mid-end beer products, while AB InBev and Carlsberg are more competitive in high-end products. (Source: Euromonitor International)

| High-end (8% of the total sales volume) | Middle-end (16% of the total sales volume) | Low-end (77% of the total sales volume) | |

| Top 1 | Budweiser (44%) | Tsingtao (30%) | China Resources (24%) |

| Top 2 | Carlsberg (16%) | China Resources (24%) | Tsingtao (17%) |

| Top 3 | Tsingtao (8%) | Yanjing (13%) | Budweiser (16%) |

The dominant sales strategy in China has traditionally been the "low price, high sales volume" and has allowed China Resources to occupy the largest market share. A major sign of tectonic level shifts within the market is indicated by China Resources change in tact towards the development of high-end products. The low price, high sales volume paradigm is being flipped on its head and trends towards "higher price, lower volume" are irrefutable. In the next several years it is conceivable that AB InBev (16.1%) will surpass the market leader Tsingtao (17.5%) due to its focus on higher end products and due to the profitability of these high-end products (occupying 44% of the high-end market). In 2018, Budweiser became the official beer sponsor of the FIFA World Cup which was a major win for it in football-crazy China. On top of this, AB InBev's localization strategy is excellent, it is able to gain considerable traction and capture the minds of China's younger generation by leveraging popular KOLs and celebrities.

In the next several years it is conceivable that AB InBev (16.1%) will surpass the market leader Tsingtao (17.5%) due to its focus on higher end products and due to the profitability of these high-end products (occupying 44% of the high-end market). In 2018, Budweiser became the official beer sponsor of the FIFA World Cup which was a major win for it in football-crazy China. On top of this, AB InBev's localization strategy is excellent, it is able to gain considerable traction and capture the minds of China's younger generation by leveraging popular KOLs and celebrities.

In response, Tsingtao is becoming increasingly cognizant of its branding and its corporate image. In recent years, it has sponsored lots of music festivals and even sponsored the ever popular New York Fashion show.

Industry Transition and Trending

|

Although the production volume of beer products went down, the market share of middle and high-end beer grows rapidly. We are looking at a change in consumption patterns where cheap and high volume is being replaced by expensive and higher quality. Chinese consumers are willing to pay a premium for experience. The alcohol content of these premium beers is also usually in line with European and American averages 3-5% compared with the traditional 2-3% of China's cheaper beers. We are seeing an almost unanimous movement towards this higher end segment amongst China's industry leaders.

►When do Chinese consumers like to drink and how is this affecting market segmentation?

Chinese consumer's drinking habits and the drinking locations are also evolving and these two factors are also influencing the market. There was a remarkable upturn in the number of purchases made for individual consumption (126%) compared to growth to purchases made for use in commercial dinners and parties (28%). Chinese consumers tend to drink a lot of their beer in their own houses watching TV or some sporting events. Here the focus of consumers is on a remarkable experience rather than simply drinking high volumes of low quality beer. The sales volume of non-draft beer during the UEFA European Football Championship increased by 91% in 2016, according to the Consumption Trending Analysis of Snack & Alcoholic drinks [10] by Alimama (affiliated to Alibaba).

►What about craft beer?

According to the Alimama report, the most important trend in the beer industry is the rise of craft beer, the turnover of which increased by 56% in 2017, higher than the growth rate of all other beers. Although the sales volume of domestic craft beer manufacturers accounts for only 1% of the market share, its annual growth reached 40% annually. China Alcoholic Drinks Association predicated it would take up to 3%-5% of the market share in the future with over 3,000 manufacturers.

Domestic craft beer manufacturers in China, by quantity

►Retails channels and how do these influence purchasing decisions?

The online sales channel is a mature and significant contributor to sales. According to Euromonitor International, 51.5% of customers preferred to purchase beer products online in 2017. However, the online channel takes up 66.8% of the sales value, which means people prefer to buy expensive beer products online.

Online/Offline sales of beer and wine products in China, by volume and value, 2017 (Source: Euromonitor International)

For more market data, please check our market data infographic: China Beer & Wine Sector: Import and Market Data 2018 [11].

For more market data, please check our market data infographic: China Beer & Wine Sector: Import and Market Data 2018 [11].

Compliance Tips

Beer National Standards required for market access

| Production standards |

|

| Product | |

| Basic standard | |

| Label |

Labeling Requirements

Besides the regulations specified in GB 7718-2011, it shall also comply with the following requirements:

1. The alcohol content shall be marked with the unit "%vol"

2. Beers shall mark the original wort concentration, titled with "original wort concentration" and the unit shall be "°P".

3. "Excessive drinking is harmful to health (过量饮酒有害健康)" shall be marked with other warnings. As for beers packaged in the glass bottle, it shall mark the warning of "do not hit to prevent the explosion of the bottle (切勿撞击,防止爆瓶)", etc.

4. To fermented alcoholic beverages and their integrated alcoholic beverages, whose alcohol content is greater than 10%vol, they can be exempted from labeling the shelf life. (GB 2758-2012)

SAMR Sampling Inspection Items (Sampling Plan 2019 [18])

| Variety | Risk Level | Sampling inspection items |

| Beer | General | Alc/vol, lead content (calculated as Pb), formaldehyde, residue amount of sulphur dioxide, the labeling of warnings |

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by