Food & Beverage Innovation Forum 2020 (FBIF2020 [1]), themed as “Technology·Revolution,” was held at Hangzhou International Expo Center from July 8th to 10th. 130+ global speakers and 5500+ decision-makers from 700+ leading companies gathered at this forum. During the forum, Hao Cheng, the Executive Director of IPSOS in China, shared his insights about the NFC (Not-From-Concentrate) juice market performance and opportunities in China.

NFC Juice Market Performance in China

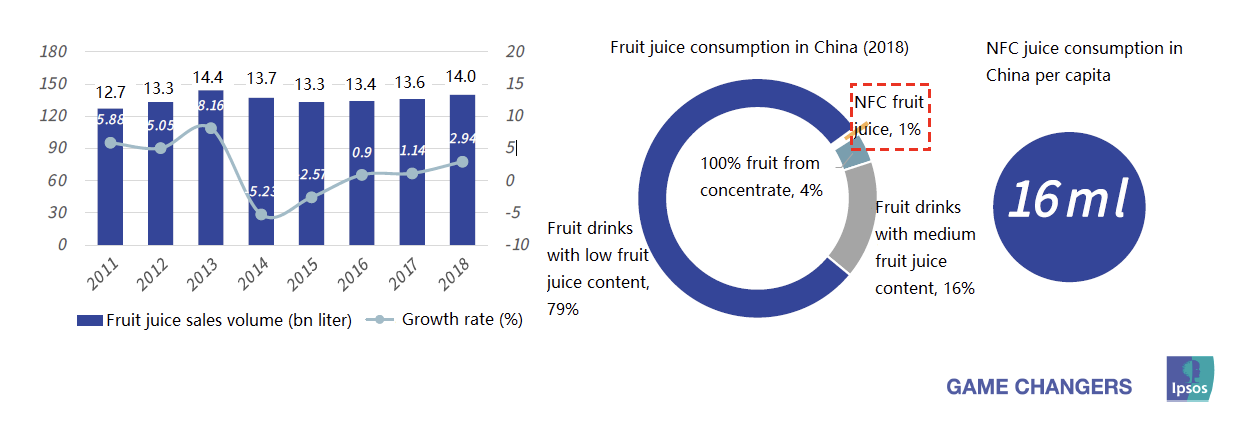

The fruit juice market in China maintained a steady performance in the past several years. In 2018, the retail sales volume of fruit juice amounted to 14 billion liters. However, only 5% were 100% fruit juice market, of which NFC juice took over 1%.

In 2018, the NFC juice consumption per capita in China was only 16 ml. Although the market size at present is quite small, there is vast room to grow, as indicated by Hao Cheng.

Consumer profile

For the time being, most NFC juice consumers are females, adults from 23 to 40 years old, consumers in the first-tier cities, and parents. IPSOS also pointed out, white collars, gym-goers and people who care about body management will be the next potential consumer groups.

And to get vitamins, health, and tasty are the top three reasons for them to purchase NFC juice and also their perception to NFC juice.

Obstacles to be overcome

In June 2012, a company called Lingdu Guofang (零度果坊) launched its first bottled NFC juice products. Eight years later, a few giant brands (such as Nongfu Spring) started to enter this market. However, the market is still quite small at its initial stage, and few consumers can figure out what NFC juice is.

After analyzing the status quo, Cheng summarized five obstacles the industry is facing and need to be solved—low recognition of NFC juice among consumers, easy to be replaced, high product price, fierce competition and fuzzy market positioning.

Low Perception of NFC juice

Hao Cheng introduced that according to the IPSOS report [2], only 35% of the consumers in China are with the correct perception of NFC juice. And the rest of them may take 100% fruit juice from concentrate as NFC juice, etc. The market still needs promotion and education. The report also found products highlight the feature “NFC” in the label would perform better than other products. For example, the 100% NFC orange juice released by Nongfu Spring is currently the top player in this sector.

Hao Cheng introduced that according to the IPSOS report [2], only 35% of the consumers in China are with the correct perception of NFC juice. And the rest of them may take 100% fruit juice from concentrate as NFC juice, etc. The market still needs promotion and education. The report also found products highlight the feature “NFC” in the label would perform better than other products. For example, the 100% NFC orange juice released by Nongfu Spring is currently the top player in this sector.

And the penetration rate of NFC juice (8%) is at the lowest level compared to other fruit juice segments. Although more people would consider NFC juice the healthiest category among all fruit juice beverages, it is not obvious when comparing it to 100% fruit from concentrate.

Competitive & Replaceable: fresh fruits, drinks in bubble tea shops, etc.

Easy to be replaced is another big subject enterprises are encountered with. And fresh fruit is the first adversary. The 2020 Healthy Drink Research shows, 25% of the reasons why consumers didn’t choose NFC juice is due to the consumption of fresh fruits and vegetables instead. Different from the markets like Japan, the fruit price is not that high. And in recent years, plenty of fruit stores are booming in first/second/third-tier cities. Consumers are in an abundant supply of domestic fruits and imported fruits.

Besides fresh fruits, the industry shall also pay attention to the threat from soft drinks from fresh juice stores, bubble tea shops, and even the juicer machine at home. According to the report, 21% of consumers would like to buy the drinks at stores like bubble tea shops, etc. And 11% would prefer to squeeze juice at home.

In June 2020, the famous F&B brand HeyTea [3] in China also launched bottled NFC juice products in its own bubble tea shop. Hao Cheng denoted it is a smart strategy to sell high-priced NFC juice in such stores, for its consumers won’t be too sensitive to the product price. Compared to the retail price of HeyTea’s bubble teas (around 25-30 RMB), the NFC juice is priced at 19 RMB. The market welcomed an influential competitor, but also it means more consumers will start to know NFC juice better.

In June 2020, the famous F&B brand HeyTea [3] in China also launched bottled NFC juice products in its own bubble tea shop. Hao Cheng denoted it is a smart strategy to sell high-priced NFC juice in such stores, for its consumers won’t be too sensitive to the product price. Compared to the retail price of HeyTea’s bubble teas (around 25-30 RMB), the NFC juice is priced at 19 RMB. The market welcomed an influential competitor, but also it means more consumers will start to know NFC juice better.

Follow-up Strategies

Mixed/Novel Flavor

In worldwide, most fruit juice products are still single-flavored, especially dominated by orange flavor. But in China, consumers are more open with mixed flavors, or a mixed vegetable and fruit juice, which offers the perception of being lower in sugar. Besides mixed flavors, exotic fruits can be another choice.

Improve Consumers’ Perception of NFC juice

The promotion of NFC juice shall be first focused on the features of products themselves, such as the highlighting of “NFC” in labels we have introduced above, and then the processing technique, feature of “additive-free,” place of origin, health benefits, etc. What’s more, it would also be important to help consumers tell the differences from FC juice (fruits from concentrate) or other juice beverages. Healthy and natural shall be the two big selling points compared to other soft drink categories.

And it’s also very important to solidify the connections between products with its consumption scenes. For example, NFC juice could be the best choice for mums in the supermarket when the kids want to buy snacks and beverages. Moreover, package design and promotions by KOLs also matter.

Elevate the Shelf Presence

Consumers are more willing to buy NFC juice in big shopping malls, convenience stores in the first-tier cities, and big fresh food stores like Hema Fresh. But there still would be a problem that usually the staff will put FC juice and NFC juice together or on the same shelf. Consumers who are with little perception of NFC juice will choose FC juice instead, which is much cheaper than NFC juice. And usually these FC juice products have already with great brand reputation and recognition among consumers. Hence, besides the further promotion of product and brand, to elevate the shelf presence or to educate consumers though the shelf presence could be another practical solution for NFC juice development.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by