Danone's New Product Development

On May 19, Danone announced that its plant-based sports nutrition brand VEGA ONE officially entered China. The products introduced include VEGA ONE Sport and VEGA ONE plant protein powder series.

VEGA ONE is a sports nutrition brand that produces plant protein powder, plant protein energy bar, plant milkshake, and other multi-category products. It is the bestselling plant protein powder in the United States. VEGA ONE was initially owned by WhiteWave (US), which was acquired by Danone in 2017 [1].

Currently, the new product sells in the VEGA ONE online flagship store on the Tmall Global platform. According to Tmall, the products will ship from the bonded warehouse, which means the importation is through cross-border e-commerce. In terms of pricing, a tub of plant protein powder (828g) sells at 548RMB (approx. $82) Two flavors: vanilla and chocolate are available now.

Chinese Plant-based Protein Drinks Market

Plant-based protein drinks are a niche market in China, with only a few plant-based protein powder products on sale. For example, domestic brand By-Health (汤臣倍健), has previously launched protein powder products such as pure plant-based protein, which consists of wheat, pea, and soy protein.

As early as 2014, Mengniu (蒙牛) set up a joint venture with WhiteWave company to bring overseas products called Silk to China and sell them under the brand name Zhipu Mill (植朴磨坊). In 2016, Danone entered this joint venture through acquisition, marking Danone's biggest acquisition in nearly a decade.

However, because growth in the plant protein beverage market has remained tepid in China, the research team of Silk was disbanded in 2019 [2], and now Silk products are unavailable in the market.

Danone's Confidence

The niche characteristic of the market has not dented Danone's confidence in continuing to pursue its plant-based business in China. Danone names protein, plant-based, and probiotics in its key growth strategy, aptly dubbed its 3P strategy.

Emmanuel Faber, the CEO of Danone, said in Barclays Global Consumer Staples Conference that [3], a growing number of consumers are increasing the proportion of plant protein in their diets. “Flexitarian diets are becoming a prominent feature of mainstream food culture. And as a result, we've already a pretty large market for plant-based. We expect it to continue to grow at a very high single-digit rate of 9% to 10% in the next five years."

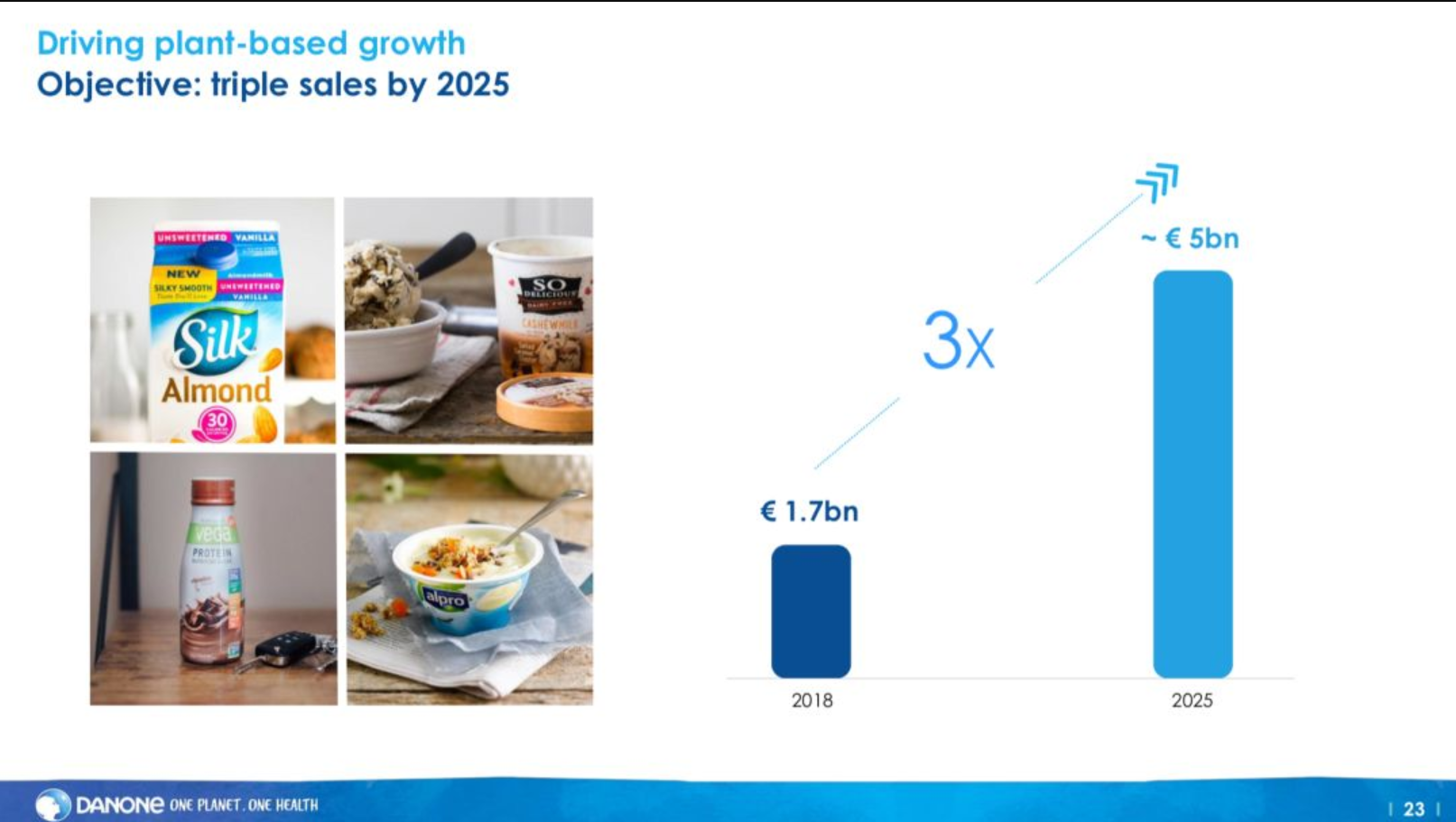

Based on this, Danone plans to reach sales of about 5 billion euros (approx. 39.2 billion yuan) in plant-based foods by 2025, three times the 1.7 billion euros annual sales (approx. 13.3 billion yuan) recorded in 2018 [1]. Danone's global sales revenue in 2019 was €25.3 billion, of which €1.9 billion was from its plant-based businesses.

Consumer's Attitude

According to a consumer survey in 2018 by Mintel, the willingness to eat more plant-based diets has grown in tandem with an increasing awareness amongst consumers of the role dietary factors play in the development of chronic diseases. The report also showed that many Chinese consumers interviewed were actively managing their health and weight by eating less animal-based products. The top reasons most respondents ate less meat were for health reasons (74%) and weight loss (45%)[1].

Mintel pointed out that [1], innovation in plant-based products is lagging behind consumer expectations, and the market for each sub-category is not yet saturated. This situation provides a significant market opportunity for companies.

However, at the same time, this industry still faces challenges, such as balancing the nutrition and taste of the products and figuring out how to make consumers more receptive to new categories.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by