During the 6th dairy China summit 2018 held in Beijing, Xu Zhiyuan from Bright Dairy delivered a keynote speech regarding China’s yogurt market and offered his forecasts on future growth and potential trends.

Growing awareness of health is changing Chinese consumer's purchasing preference

China’s expanding epidemic of chronic diseases has pushed government to formulate new nutritional policies and national health initiatives. Now we can see more and more people, especially the young, are paying greater attention to a healthy lifestyle. Nowadays they prefer to food with low salt/oil/sugar content and keep healthy by doing sports.

China’s expanding epidemic of chronic diseases has pushed government to formulate new nutritional policies and national health initiatives. Now we can see more and more people, especially the young, are paying greater attention to a healthy lifestyle. Nowadays they prefer to food with low salt/oil/sugar content and keep healthy by doing sports.

In 2017 360 million Chinese regularly engaged in physical exercise, and the number may climb to 500 million by 2025. The growing awareness of health has elevated the importance of China’s food sector particurly its healthy food and sports nutrition segment. High-protein products have garnered considerable public attention in China in recent years. 88% of fitness people would choose high protein foods as a major source of energy and to strengthen muscles. Besides it is increasingly popular among consumers for non-sports nutrition related purposes primarily for consumers targeting weight loss and body re-composition.

In 2017, the sales volume of normal temperature yogurt and fresh yogurt increased by 27% and 8% respectively, suggesting that dairy products with high protein content are popular and offer great market potential. As high protein yogurt appeals to both dairy lovers and sports nutrition enthusiast and both sectors offer excellent growth potential we can expect great things from this intersectional healthy food.

High protein yogurt market overseas

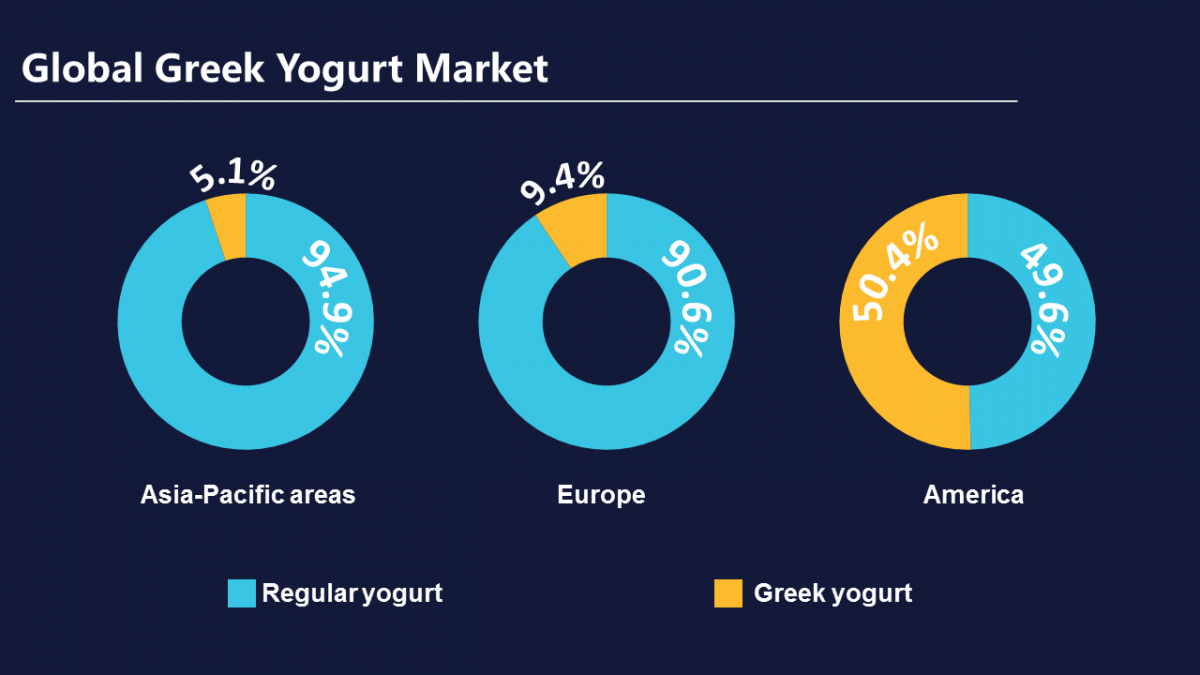

Greek yogurt (also named strained yogurt), is characterized by its high protein, high-calcium and low-fat content and is now extremely popular in America (see chart below). In 2011, the sales volume of Greek yogurt reached 1 billion dollars, representing 25% of the yogurt market. Technavio statistic shows that its market share exceeded 50% in 2015, sustain growth of 5% each year.

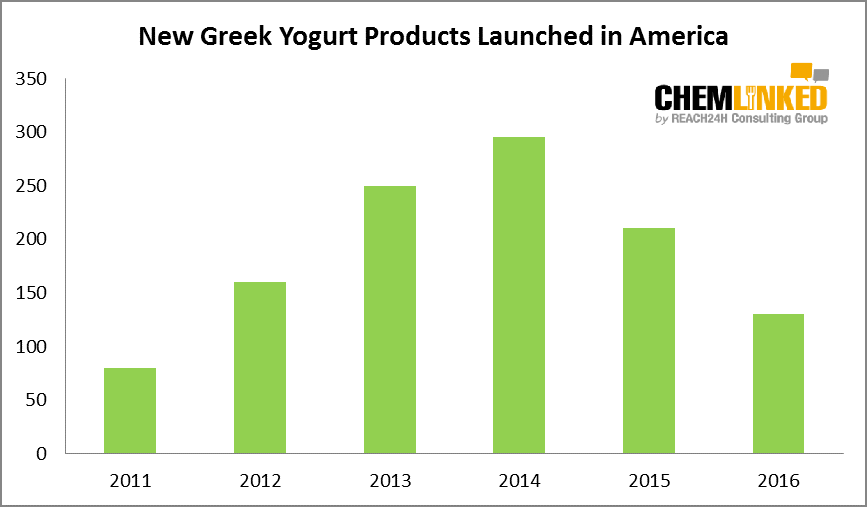

America is also the country with the most diversified Greek yogurt products. More than 100 types of new products are launched in America each year and the number peaked at nearly 300 in 2014. Chobani, Yoplait, Danone and FAGE are all major stakeholders in the American Greek yogurt market.

Growth in health awareness, sports nutrition marketing and the diet/weight loss sectors have all contributed to the increase in interest in Greek yogurt in America. Besides, many youngsters are attracted by its unique taste and flavor which is very thick due to whey straining. Advertisement is also a key factor in its success. Traditionally yogurt is consumed after meals to aid digestion. However Greek yogurts strong association with other market segments has moved it from a post meal food to a post sport or healthy snack.

Greek yogurt in China

The Greek yogurt sector is relatively underdeveloped in China currently, and only a few brands appear in the market, such as LePur, and yoGreek produced by Bright Dairy. Though the former one is now the most successful Greek yogurt brand in China and the latter is backed by one of China’s domestic dairy giants, the sales volumes of these products is still only tens of millions RMB each month, accounting for a tiny proportion of the entire yogurt market. In general, the development of Greek yogurt has been temporarily halted due to 3 issues:

Price: due to the high protein content of Greek yogurt (usually over 6%), its price is nearly three times than that of regular yogurt (4-6 RMB), reaching over 12 RMB. This high price affects demand.

Perception: Greek yogurt is still relatively unknown amongst Chinese consumers

Taste & flavor: Greek yogurt offers a different sensory experience compared to traditional yogurt and is characterized by roughness, higher viscosity and a granular mouth feel. In addition, Greek yogurt is low fat and low sugar, making the product taste somewhat bland. These properties combine to offer a unique sensory experience which Chinese taste buds are unaccustomed to which may also explain some of the reasons for Greek yogurts slow growth.

According to dairy industry expert Xu Zhiyuan Greek yogurt can overcome these obstacles in the following ways:

1. Target consumer demographics need to be realigned and marketing channels should reflect this change: Greek yogurt offers a prohibitive price for regular consumers in traditional supermarkets. New sales channels should include gyms, health and fitness centers, convenience stores and online platforms (particurly health and fitness orientated platforms/flagship stores).

2. The flavor and taste should be further improved to accommodate Chinese consumer purchasing and sensory preferences.

3. Greek yogurt products need more diversification in China. When more products appear in the market, it may be easier for consumers to accept this new category. Besides, the competent authorities and industry associations should release some policies to increase consumption of high protein food.

Greek yogurt's future in China

Although Greek yogurt is still a niche product in China, Zhou Zhiyuan is very optimistic about its future development. The decline in demand for flavored milk is indicative of a growing demand for healthier options and increased interest in value-added dairy. In addition, despite the increased popularity of sports and fitness in China, the sales volume of sports nutrition and associated market segments represented only 4% of the total health sector from 2011 to 2016. There is a huge room for development and it is predicted that the compound growth rate will be more than 21% over the next several years.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by