Import Volume Increasing

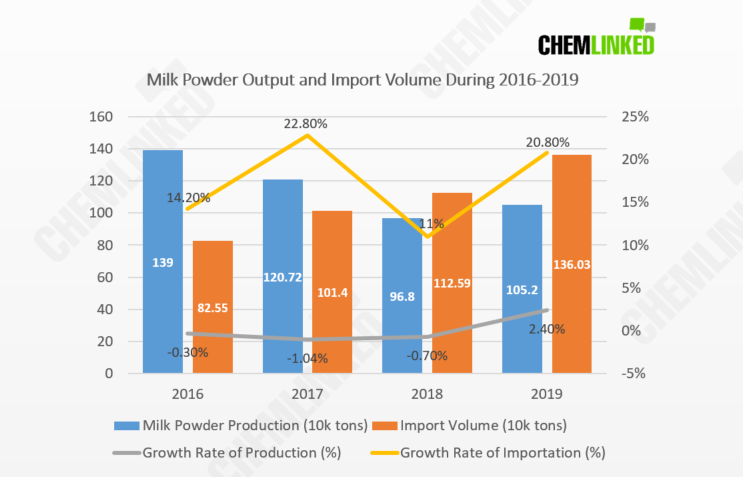

Since 2016, China's milk powder domestic output has been on a downward trend. Although China's milk powder output reached 1.052 million tons in 2019 [1], ending the continuous decrease, the year-on-year increase was only 2.4%.

The total amount of imported milk powder has increased steadily. In 2018 import volume exceeded domestic output for the first time. In 2019, the growth rate of imported milk powder was over 20% [1], which further widened the gap with domestic output.

Import Value Occupied Over a Half of the Market

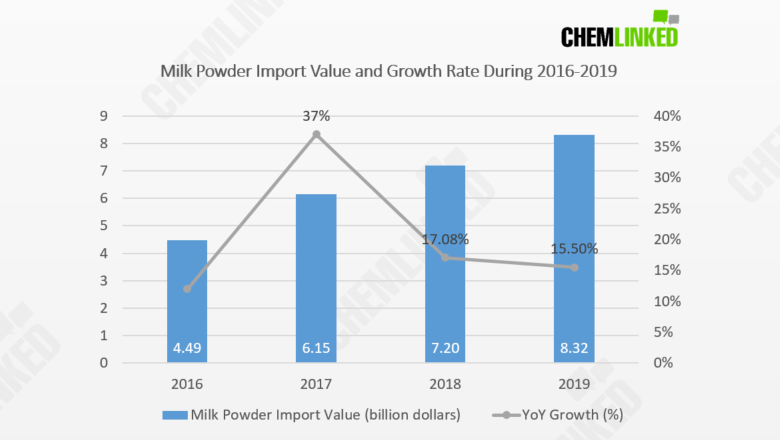

According to GAC, the amount of milk powder imported from 2016 to 2019 increased year by year, reaching $8.315 billion (approx. 58 billion yuan) in 2019, which is more than half of the sales revenue of China's milk powder industry.

Revenue and Profits Show Inverse Proportionality

In 2018, the sales revenue was only 102.22 billion yuan (approx. $15.3billion), the lowest in the last three years, down about 13% year on year [1]. However, the profitability of milk powder products in China has trended upwards since 2016. In 2018, the total profit reached 10.96 billion yuan (around $1.6 billion), up about 7% year on year. The asset scale of the industry also expanded, with total assets of 90.44 billion yuan (about $13.5 billion) in 2018, up 8.5% year on year [1].

The Top Ten Players Have Stranglehold on Market

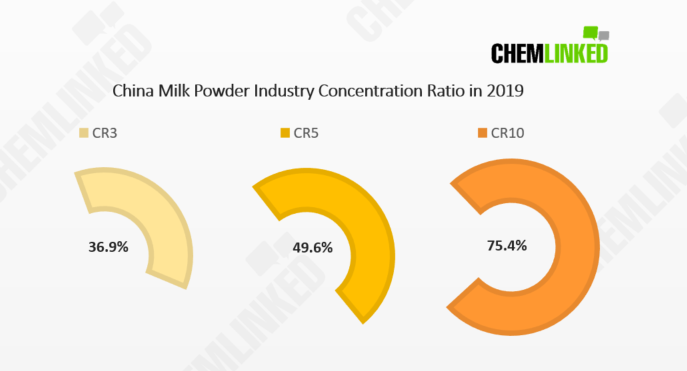

During the 2019 recap webinar last year, we mentioned the high concentration of China's milk powder market [2]. There is fierce competition in China's industry, and leading enterprises possess monopolistic advantages. Most of the small- and medium-sized enterprises subsist on niche market spaces and have low profits [3]. Situations have not changed; what's more, the concentration of the domestic milk powder industry is still moving towards further consolidation. According to Nielsen[3], in 2019, the market share of the top ten milk powder enterprises was still growing, rising by 2.9 percentage points to 75.4%. Besides, the share of CR3 and CR5 in China's milk powder industry in 2019 was 36.9% and 49.6% [3], respectively.

*** Generally, when CR10 exceeds 70%, the market is defined as a monopolistic market.

In addition, China's top domestic milk powder firms are still able to maintain rapid growth. Take Firmus (Feihe) as an example. In 2019, the operating revenue of Firmus (Feihe) reached 13.72 billion yuan (approx. $2 billion) [4], with a year-on-year growth of 32%, and a net profit of 3.93 billion yuan, with a year-on-year increase of 75.5%.

To know more about the performance of infant milk powder head players in 2019 in China, you can click here.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by