The use of meal replacement products is prevalent in the United States [1]. High rates of obesity and related disease have made local people aware that some processed foods have seriously harmed their health. In addition to providing a variety of nutrients for the human body, meal replacements are often tailored to specific energy values and macronutrient profiles e.g. high protein/low carb, high fiber, low in calories, etc.

According to a market survey conducted by Welch's in 2017 [2], the young generation of America has shown a relatively high demand for meal replacement products.

High Demand & Rapid Growth

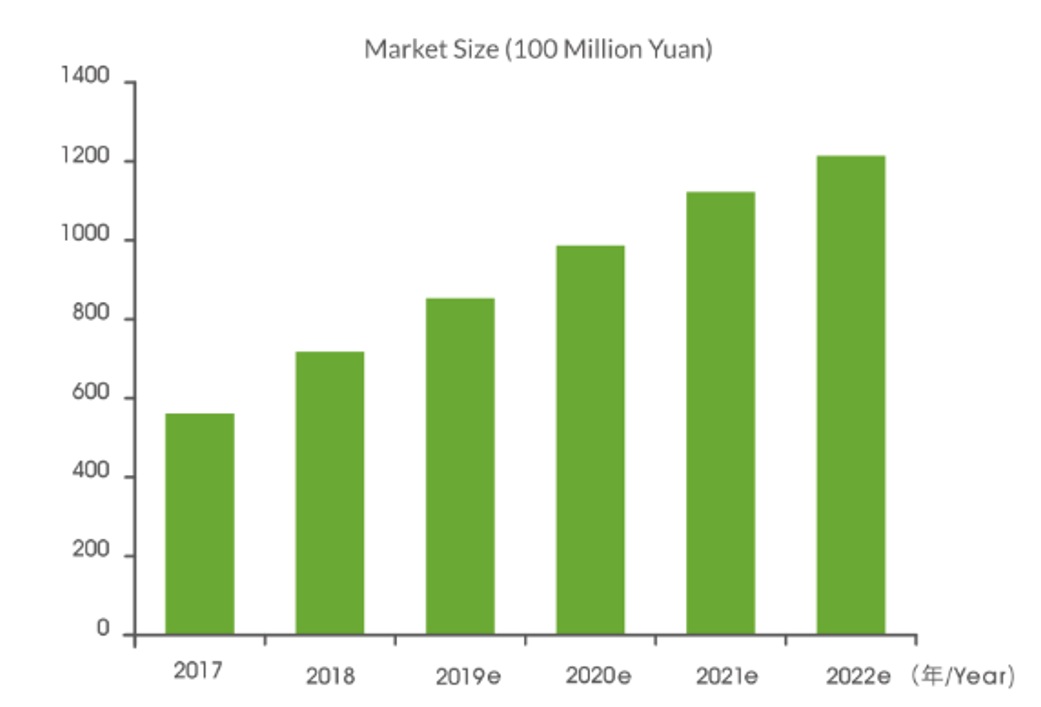

The data shows that [3], the obese population (BMI>30) in China exceeds 60 million, and the overweight population (BMI>25) is 200 million, providing fertile ground for the growth of the meal replacement sector in China. This market in China is expected to reach 120 billion yuan in 2022 [3].

The meal replacement market growth is over 50% [3]. Among all categories, nutritional beverages are the fastest-growing segment, with a compound growth rate of 12%. Sales have increased by nearly 100 times in China during 2011-2016 [3].

Low Maintenance of Consumers

Even though the meal replacement market in China continues to rise, the product repurchase rate is low. Retaining customers is a major problem.

Smeal, a meal replacement brand, has over 1.1 million fans/followers on Tmall. The average single purchase price of consumers is around 200 RMB ($30), and the online repurchase rate in 2019 was 20% [4]. After a period of use, this rate will subsequently decline; this is a problem not only for Smeal but also for other brands.

Why is China's market not larger?

Although the overall market shows growth trends in China, China's market is not overly enticing compared to the US market. Reasons for this disparity include:

1. Chinese people prefer hot dishes, whereas meal replacement usually is reconstitutable or ready-to-eat food. In western countries, such as the US, the diet is generally based on sandwiches, bread, milk, and other room temperature or refrigerated food. The primary food substitutes in China include milkshakes, nutritional powder, energy bars, etc. These do not align with the dietary patterns of Chinese people.

2. Chinese food choices are remarkably diverse, and tastes vary significantly according to geography. For the meal replacement market to grow faster, it will require Chinese consumers to expand their food choices even further and to accept foods that do not align with traditional Chinese eating habits. Additionally, diversifying meal replacement products will help prevent the fatigue and emotional burden of eating the same food repeatedly [1].

3. The local takeout system has been crowding meal replacement out of the market, and the domestic snack brands are developing new products at a fast pace. Moreover, both options, food takeout service and leisure food are more attractive to Chinese consumers [1]. Mobile delivery apps have a high penetration rate among young Chinese, with food delivered within half an hour after ordering. Milkshakes, energy bars are more like snacks at work to avoid hunger. However, in China's snack market, products such as nuts and sugar-free beverages are more satisfying for Chinese consumers.

***This picture shows an offline leisure food store in China.

4. Miss Zero (超级零), a Chinese domestic meal replacement brand [7], advertises that eating a box (around 250RMB, approx. $37) of its product could help a customer to lose 2.5kg in three days. The primary purpose of meal replacement products in China is to lose weight [3]. After that weight is lost, what will a consumer do? As there is a definitive endpoint associated with consuming the product, i.e., the consumer reaches the target weight, repeat purchases are limited.

5. The regulatory framework is not complete, meaning product quality is not standardized. There is no national standard for meal replacement in China, and currently, only a Group Standard published in November 2019 is available as a reference for industry[5]. There have many reports of consumers having health problems after eating meal replacement products. Some experts point out[6] that most of the meal replacements sold on e-commerce platforms are unqualified products, without ingredients and origin clarified on the label, and lack of standardized clinical verification.

For detailed info about the Meal Replacement Group Standard, please click here.

***Disclaimer: All images used in this article are from the internet.

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global food market entry services (including product registration, ingredient review, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by